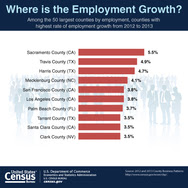

Information Sector Posted Fastest Job Growth Among the 50 largest counties with the most employees, Sacramento, Calif., had the highest rate of employment growth among all sectors between 2012 and 2013 (up 5.5 percent to 428,475), according to new U.S. Census Bureau statistics released today. Sacramento was followed by two Texas counties: Travis (up 4.9 percent to 514,749) and Harris (up 4.7 percent to 2.0 million). Annual payroll in Sacramento rose 9.9 percent to $20.9 billion for the same period. Delaware led all states in rate of employment growth between 2012 and 2013 with employment levels climbing 5.1 percent to 382,128, followed by Washington (up 3.5 percent to 2.4 million) and California (a 3.5 percent increase to 13.4 million). Payroll in Delaware increased 6.7 percent to $19.5 billion. Nationally, employment in the information sector ( NAICS 51) of the nation’s economy rose 4.1 percent between 2012 and 2013 to 3.3 million, besting every other sector in rate of growth. The sector also saw its payroll rise 7.0 percent to $273.3 billion and its payroll per employee climb 2.8 percent to $83,677. These new findings released this week are from County Business Patterns: 2013, which provides the only detailed annual information on the number of establishments, employees, and quarterly and annual payroll for nearly 1,200 industries at the national, state and county levels. “The 2013 County Business Patterns provide the first snapshot of business activity locally since the 2012 Economic Census was conducted,” said William Bostic, the Census Bureau’s associate director for economic programs. “Its findings show the extent to which high-speed global communications and networking drives our economy.” The information sector’s gains were propelled by the data processing, hosting and related services subsector ( NAICS 518), which added more than 87,000 employees from 2011 to 2013 (a rate of growth of 21.9 percent). This subsector includes establishments that specialize in application and Web hosting, video and audio streaming services, and application service providers. A related subsector, other information services ( NAICS 519), saw employment levels rise 22.4 percent over the 2011-2013 period, adding more than 40,500 employees. Other information services include establishments such as news syndicates, firms that publish and/or broadcast exclusively to the Internet, Web search portals, libraries and archives. In contrast, a more traditional information subsector, broadcasting (except Internet) (NAICS 515), experienced a 5.7 percent employment gain over the 2011-2013 period, adding just over 15,000 employees.

State and County Highlights- California had more establishments (874,243) and employees (13.4 million) and a larger annual payroll ($742.5 billion) than any other state in 2013. Texas followed in each measure (547,190 establishments, 9.7 million employees and $468.4 billion in annual payroll). New York ranked third in all three measures: 532,669 establishments, 7.7 million employees and $466.8 billion in annual payroll.

- Los Angeles, Calif., led all counties in the number of establishments (253,227) and employment (3.8 million) followed by Cook, Ill., in both measures (129,972 establishments and 2.3 million employees).

- New York, N.Y. (Manhattan) topped all counties in annual payroll, at $217.6 billion, while ranking third in establishments (105,439) and employees (2.1 million).

Industry Trends· Health care and social assistance employed more people than any other sector in 2013 (18.6 million, up 3.0 percent from 18.1 million in 2011). Employment in this sector has risen steadily for more than 10 years, gaining almost 3.7 million employees since 2002. · Retail trade led all sectors in the number of establishments in 2013, with 1.1 million (remaining steady since 2011). This sector employed 15.0 million workers in 2013, up 2.2 percent from 14.7 million in 2011. · Employment in the accommodation and food services sector rose 7.3 percent (839,102) since 2011. · Mining, quarrying, and oil and gas extraction showed impressive employment growth between 2011 and 2013: 12.4 percent (adding 80,982 employees). · Transit and ground passenger transportation employment rose 5.9 percent (26,432) since 2011. General Highlights - Nationally, the number of establishments was up 0.8 percent, from 7.4 million in 2012 to 7.5 million in 2013.

- Employment rose 2.0 percent, from 115.9 million to 118.3 million.

- Annual payroll was up 3.8 percent, from $5.4 trillion to $5.6 trillion.

- Average payroll per employee climbed 1.8 percent, from $46,699 to $47,534.

County Business Patterns excludes business owners who were self-employed, employees of private households, railroad employees, agriculture production workers and most government employees. The statistics are broken down according to employment-size classes (for example, number of establishments with one to four employees) and legal form of organization (for instance, corporations and partnerships). Definitional and coverage differences may affect the direct comparison of economic census data and County Business Patterns data. See the Survey Methodology for more details. County Business Patterns data are also available for Puerto Rico, Guam, American Samoa, the Commonwealth of Northern Mariana Islands and the U.S. Virgin Islands. Information on businesses without paid employees is released as part of the upcoming 2013 Nonemployer Statistics report in May 2015. County Business Patterns data by five-digit ZIP codes will also be released in May 2015. Industry Snapshots Expanded The Census Bureau has launched its expanded Industry Snapshots data access and mapping tool, which for the first time includes annual statistics from County Business Patterns. This tool permits users to select any industry and pull up state-level data tables and county-level thematic maps on key measures such as number establishments, employment, and payroll, as well as per capita ratios using data from population estimates. Previously, this tool presented data only from the economic census. Other Sources of Local Area Economic Data The U.S. Census Bureau conducts an economic census every five years and provides a comprehensive and detailed profile of the U.S. economy, covering millions of businesses representing more than 1,000 industries and providing unique portraits of American industries and local communities. Economic census statistics for 2012 are being released over a two-year period. Statistics at the local level, including information for more than 5,000 communities not available from previous economic censuses, became available starting in January 2015 and will be released on a flow basis over the course of the remainder of 2015. These Geographic Area Series reports are the only source of detailed economic information for more than 15,000 cities, towns and other similar places in the U.S. and provide statistics on measures that County Business Patterns does not. |

No comments:

Post a Comment